Making Tax Digital for VAT Bridging Software for Excel

If you use Excel (or any other spreadsheet) to keep your business records, and your business is VAT registered, you will need bridging software to comply with HMRC's Making Tax Digital for VAT (MTD for VAT).

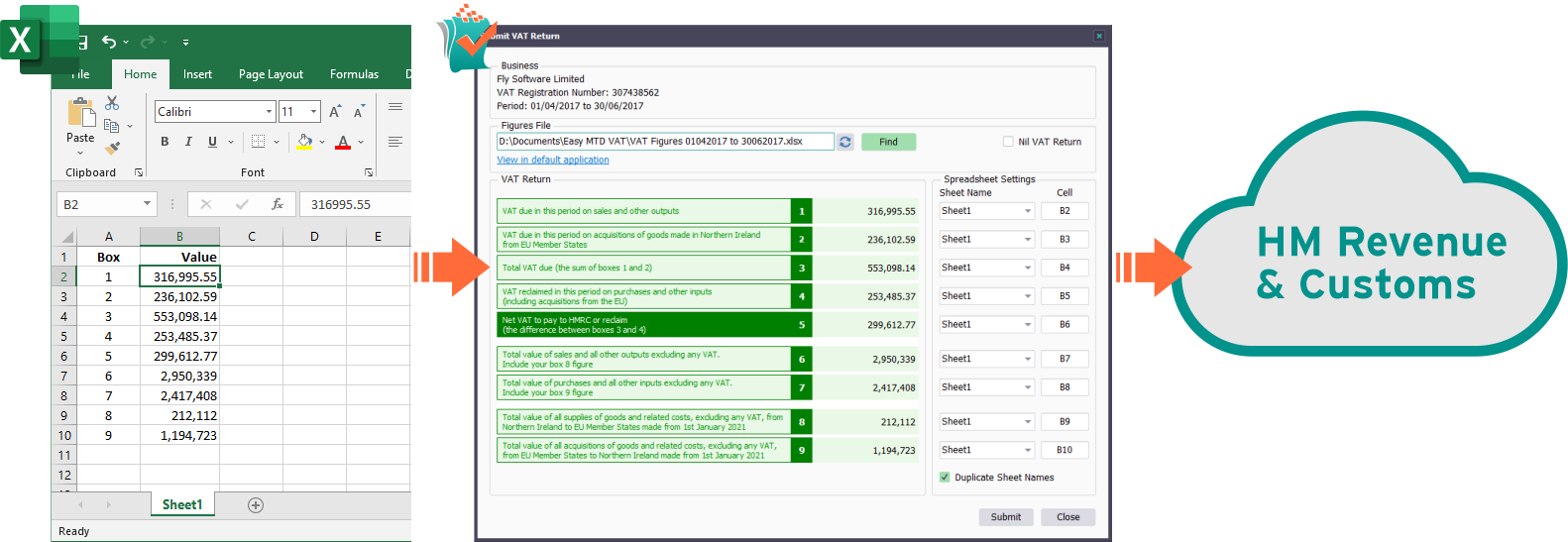

Using a spreadsheet to keep your business records is an accepted way for you to comply with MTD for VAT. However, spreadsheets such as Excel cannot submit your VAT figures to HMRC so this is where bridging software such as Easy MTD VAT saves the day. The software sits between the Excel spreadsheet and the MTD for VAT system and enables your VAT figures to be submitted digitally to HMRC.

Importing VAT figures from Excel into Easy MTD VAT then submitting to HMRC

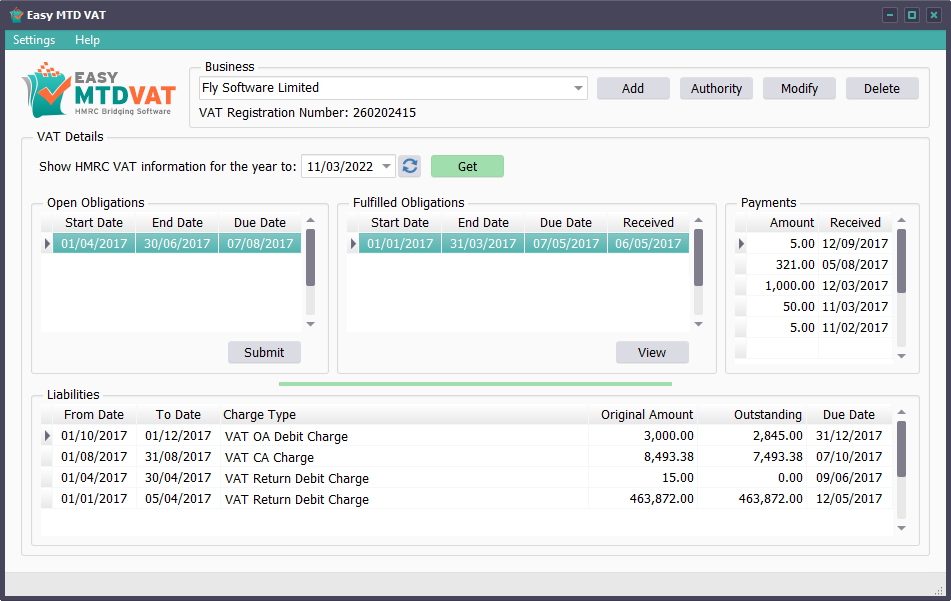

Easy MTD VAT is a windows application recognised by HMRC for use with their MTD for VAT system. It enables VAT returns to be digitally submitted in just a few clicks. It also allows you to view VAT obligations, liabilities and payments that are held by HMRC.

Easy MTD VAT main interface

Even if you use another spreadsheet or accounting software that is not MTD for VAT compliant, as long as it can export your VAT figures to an Excel (xlsx, xls, xlsm) or comma-separated values (csv) file you can use Easy MTD VAT to submit your VAT returns.

If you don't already have an Excel spreadsheet then download one of our templates. These enable you to input your sales and expenses and automatically calculate the 9 box figures of a VAT return ready for submitting to HMRC using Easy MTD VAT.

Easy MTD VAT is compatible with Excel spreadsheet files in the xlsx, xls or xlsm format. The xlsx format is the standard for Excel 2007, Excel 2010, Excel 2013, Excel 2016, Excel 2019, Excel 2021 and Excel for Microsoft 365. The xls format is the standard for Excel 95, Excel 97, Excel 2000, Excel 2002 and Excel 2003.

If your spreadsheet is held in another Excel format such as xlsb or even another spreadsheet format such as Google Sheets or OpenOffice Calc, then save it as an xlsx, xls or xlsm file prior to using with Easy MTD VAT.