Making Tax Digital for VAT Bridging Software for Google Sheets

If you use Google Sheets to record your business figures and you are a VAT registered business, you will need bridging software to comply with HMRC's Making Tax Digital for VAT (MTD for VAT).

Using a Google Sheets spreadsheet to record your business figures is an accepted way for you to comply with MTD for VAT. However, Google Sheets is unable to submit your VAT figures to HMRC so bridging software such as Easy MTD VAT must be used.

Easy MTD VAT is only compatible with Excel (xlsx, xls, xlsm) and comma-separated values (csv) files, so your Google Sheets spreadsheet must be saved in one of these formats before your VAT figures can be submitted to HMRC. This too is permitted by HMRC because it maintains the digital link they require for compliance with MTD for VAT.

Saving a Google Sheets spreadsheet to an Excel (xlsx, xls, xlsm) or comma-separated values (csv) file, importing the VAT figures into Easy MTD VAT then submitting them to HMRC

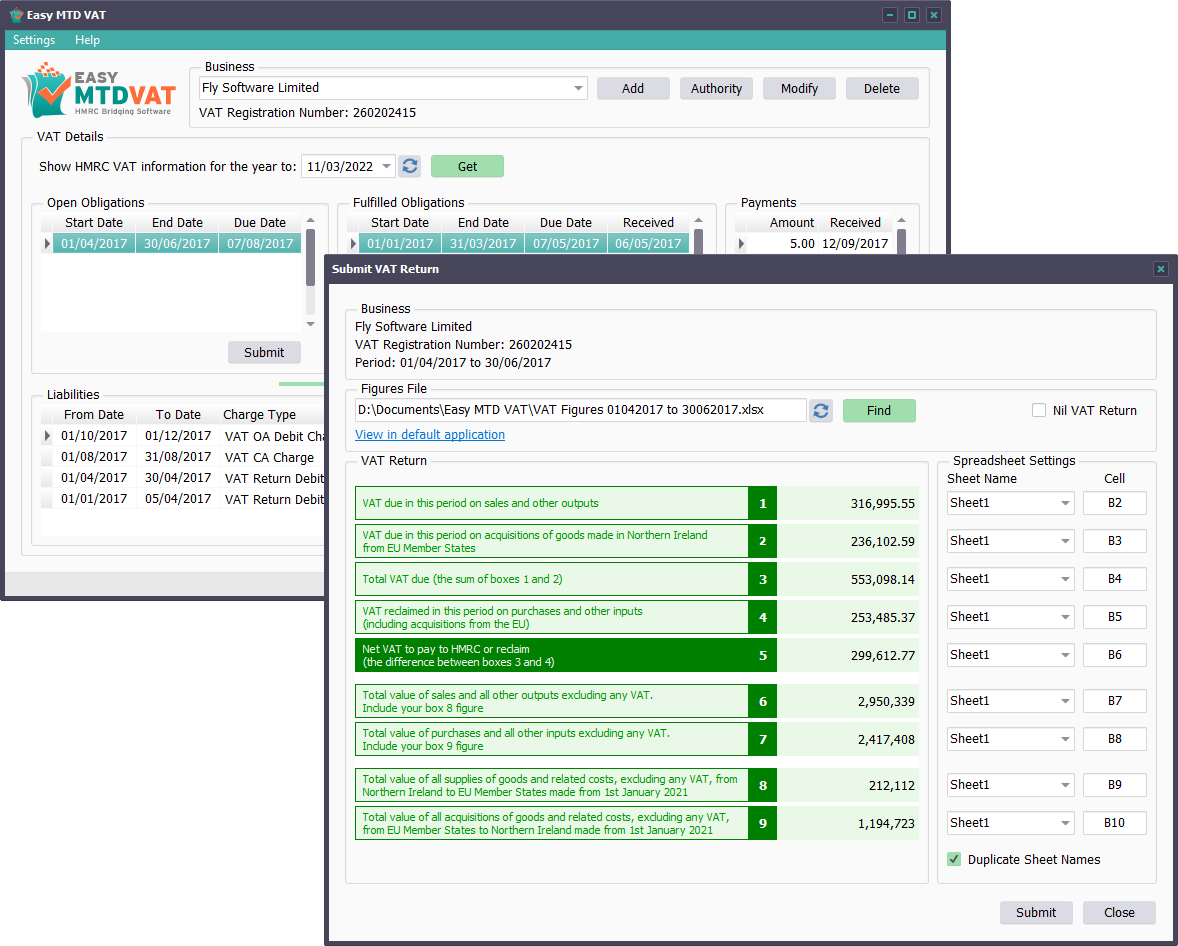

Easy MTD VAT is a Windows application that is compatible with HMRC's MTD for VAT system. It enables VAT returns to be submitted to HMRC and enables VAT obligations, liabilities and payments held by HMRC to be viewed.

Easy MTD VAT main interface and Submit VAT Return window