Why am I seeing errors in red after trying to import my VAT figures?

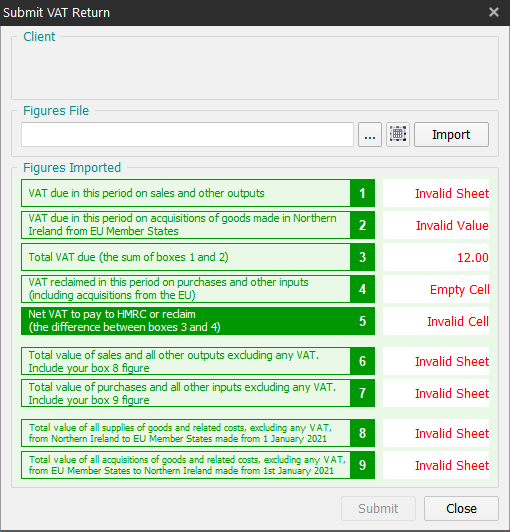

Prior to submitting a VAT return to HMRC, it is important the figures being sent are correct and what HMRC would expect. For this reason Easy MTD performs a number of checks on the VAT figures it tries to import and if a check fails it is reported in the associated box in the Submit VAT Return window.

Below is a list of the errors, what they mean and how to correct them:

| Error | Description | Solution |

|---|---|---|

| Empty Cell | The cell in the spreadsheet does not contain a value. | Specify a cell where the corresponding VAT figure exists in the spreadsheet. |

| Invalid Cell | The cell format is invalid or does not exist in the spreadsheet. | Specify a cell where the corresponding VAT figure exists in the spreadsheet. |

| Invalid Sheet | The sheet does not exist in the spreadsheet. | Specify the sheet name where the corresponding VAT figure appears in the spreadsheet. Click here for further details about sheets. |

| Invalid Value | The cell does not contain a number or the VAT figure is not equal to a value that is expected based on other VAT figures (e.g. box 3 must be the sum of boxes 1 and 2). | Specify a cell where the corresponding VAT figure exists in the spreadsheet and/or ensure the VAT figure is calculated correctly in the spreadsheet. |

| Number | The VAT figure is not equal to a value that is expected based on other box figures (e.g. box 3 must be the sum of boxes 1 and 2). | Ensure the VAT figure is calculated correctly in the spreadsheet. |

Note: Boxes displayed in orange will not prevent the VAT return from being submitted (unlike boxes displayed in red). They are displayed in orange to indicate the VAT figure has been calculated by Easy MTD or not used.