Making Tax Digital for VAT Software for Submitting Nil/Zero Returns

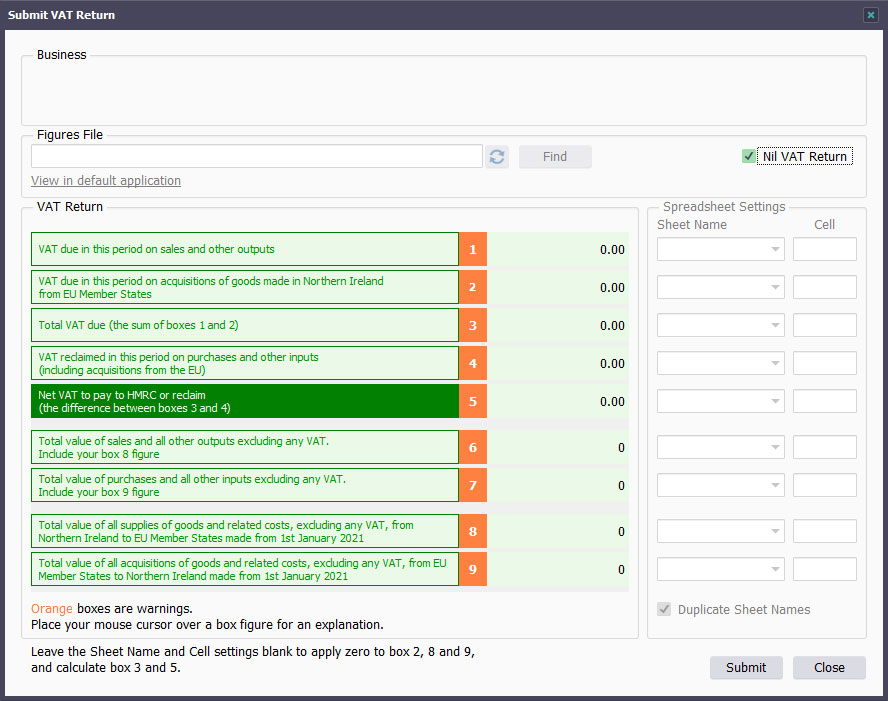

If you need to submit a nil/zero return while adhering to HMRC's Making Tax Digital for VAT, using Easy MTD VAT is the simplest way to achieve this. There is no requirement for nine zero figures to be in a spreadsheet or other file, instead you simply tick a "Nil VAT Return" checkbox in Easy MTD VAT prior to the nil/zero return being submitted to HMRC.

Submitting a nil/zero VAT return is as simple as ticking a checkbox

Not only is submitting a nil/zero VAT return using Easy MTD VAT extremely simple, the cost to do so starts from as little as £2+VAT per submission. Furthermore, you can submit your first nil/zero VAT return for free after signing up for an account on this website.